what is suta tax texas

FUTA or Federal Unemployment Tax is a similar tax thats also. 11 hours agoIf Austin Rep.

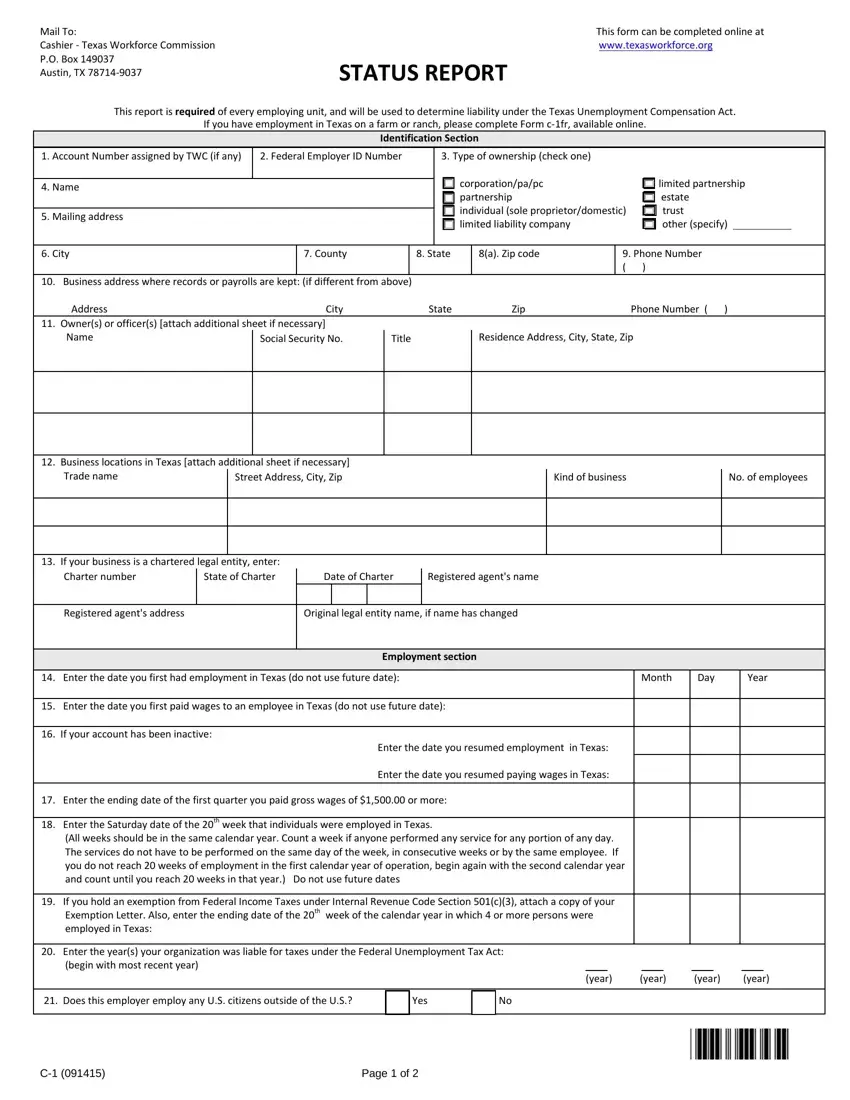

Payroll Software Solution For Texas Small Business

See Common Law Test.

. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the. Texas defines wages for state. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

SUTA was established to provide unemployment benefits to. It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor. Texas uses the common law test for determining a workers status for unemployment insurance coverage purposes.

Texas Unemployment Tax Rate Range Remains the Same. SUTA is a tax paid by employers at the state level to fund their states unemployment insurance. A Texas lawmaker R-Jared Patterson proposed a bill to dissolve the city of Austin into the District of Austin citing High crime and taxes.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. While the Texas unemployment tax rate range remains the same for 2021 from a minimum of 031 percent to a. There are many types of taxes from federal state sales property and FICA taxes which gives the government many sources of revenue.

FICA FUTA and SUTA Taxes Explained. SUTA stands for State Unemployment Tax Act. The taxable SUTA wage base remains the same for both businesses in the.

This means that a new employer could pay up to 102375 in SUTA taxes per employee. Donna Howards latest bill makes it through the Legislature and becomes law Texas will join 24 other states that dont tax feminine hygiene products.

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Texas Is Underfunding Unemployment To Keep Business Taxes Low Now It Owes 7 Billion And Counting Tpr

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

Baity Assoc Tax And Financial Services Inc Texas Workforce Commission Notice To Employers Regarding Tax Rates Https Apps Twc State Tx Us Uitaxserv Security Logon Do Facebook

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Texas Unemployment Agency S Bank Account Drained Now Borrowing Federal Money To Pay Out Of Work Texans Wfaa Com

Fast Unemployment Cost Facts For Texas First Nonprofit Companies

3 11 154 Unemployment Tax Returns Internal Revenue Service

Twc Finally Issues 2021 Unemployment Tax Rates

Texas Payroll Services And Regulations Gusto Resources

Important Texas Tax Updates Rosenblatt Law Firm

Texas Workforce Commission Lowers Employer Tax Rates For 2020 Corridor News

Unemployment Insurance Cost Facts Every Texas Nonprofit Should Know First Nonprofit Companies

What Are Employer Taxes And Employee Taxes Gusto

Ui Tax Structure Smarter Taxes American Institute For Full Employment